Overview

In the modern business environment merchants who lack online payment capabilities are operating at a severe disadvantage. The convenience of purchasing goods and services via the internet is now expected by customers, and businesses lacking such capabilities will lose market share to better equipped competitors. Today every merchant should be able to handle payments from online customers in a safe and secure manner.

Tangible Payments Payment Pages (“Payment Pages”) provide an outsourced solution for those

merchants who wish to take payments from online customers, but who do not wish to incur the expense of developing and maintaining their own secure payment portal. Payment Pages allow your customers to make credit card or Automated Clearing House (electronic check) payments via a secure PCI DSS compliant portal that maintains the look and feel of your corporate website. Sensitive payment information, such as credit card or bank account numbers, is handled by our secure system and stored in an encrypted data base. Payment Pages provide your customers the convenience of making payments online, while protecting your business from liability issues related to handling sensitive customer data.

Tangible Payments Payment Pages are fully integrated with the Tangible Payments Gateway, a PCI DSS compliant payment processing system.

Payment Pages Functionality

The following section provides more details about the Tangible Payments Payment Pages online payments solution.

Customer Payment Process

The following actions are taken by the customer when using Payment Pages:

- Link to payment pages

- Enter and confirm payment information

- Make payment

- Receive receipt

Link to Payment Pages

Customers access Payment Pages by following a link from your corporate website.

this link will be configured to pass additional data to the payment page. For example; transaction data gathered by a site’s “shopping cart” (purchase codes, customer account information and the amount of the transaction) would be passed to Payment Pages.

Passed data can also consist of any data generated internally by your systems that might be useful or necessary to your internal business processes. (For example, if customer no. 2482 in your ledger was making a payment, then this customer code could be passed to the Payment Pages and stored in our secure data base.) As different businesses have different needs Tangible Payments provides ten custom code fields for the storage of your data.

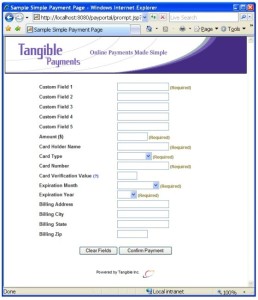

This data would be passed to the Payment Pages automatically when your customer clicks the link. Once the link is clicked the customer is taken to the Enter Payment Page. Depending on the configuration required by your business some of the data fields on this screen may be marked as required, pre-populated with data passed from your corporate website or set as read only and/or hidden from the customer’s view. This screen would also be customized to match the look and feel of your corporate website.

The following figure shows an example Enter Payments Page with a Tangible Payments banner and five Custom Code Fields. A real page would have your website’s header instead of our banner and the names of the Custom Fields would be specific to your business.

Figure 1: Example Enter Payment Page

Enter and Confirm Payment Information

On the customized Enter Payment Screen the customer is prompted to enter their credit card or bank account information. Once they have entered their payment information the customer clicks the Confirm Payment button. (If any fields which have been marked as required are empty the system will Alert the customer to this and prompt them for the information again).

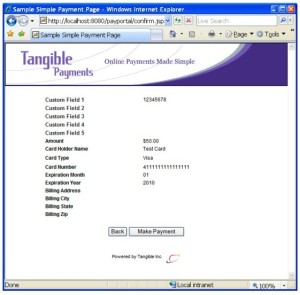

Clicking the Confirm Payment Button takes the customer to the Confirm Payment Page. On this page the payment data is displayed again, in read only format, encouraging the customer to double check that it is accurate.

Figure 2: Example Confirm Payment Page

Make Payment

After reviewing their payment information on the Confirm Payment Page the customer clicks the Make Payment button. (Double click protection is built into the page to prevent multiple payments being made by accident.) This submit’s the payment to the Tangible Payments Gateway, our PCI DSS compliant payment system. The Tangible Payments Gateway validates and processes the payment and returns the information needed to generate a receipt to the Payment Pages.

The Tangible Payments Gateway can validate a credit card payment on multiple levels, depending on your business needs. Card number, credit limit (max amount) and expiration date verification are conducted for all credit card payments, but address verification and CVV verification can also be performed if a merchant requires. If a payment fails any of these verification checks then instead of a receipt the customer will receive a notice that the payment was declined.

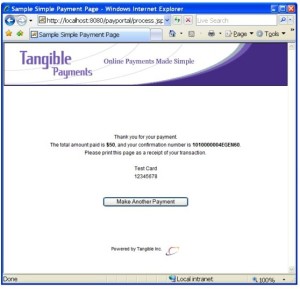

Receive Receipt

After the payment is processed, the Payment Pages presents the customer with a Receipt Page. At a minimum the amount paid and a confirmation number will be displayed. The Receipt Page can be customized to also display other payment information which the customer may want or need for their records. Going back to our earlier example; (customer no. 2482) the customer number could be included for the customer’s reference.

Figure 3: Example Receipt Page

Any information included in the payment can be displayed in this manner. (In the Example Receipt Page the Card Holder name (Test Card) and the contents of Customer Code Field 1 (12345678) are displayed.)

The confirmation number displayed on the Receipt Page is the Transaction ID of the payment in the Tangible Payments system, and can be used to look up, or update, the payment in the Tangible Payments Payment Processing system.

Payment Pages Customization

The following section provides more details about the customization of Tangible Payments Payment Pages to meet your business’s needs.

Customization Elements

The following elements are included when using Payment Pages with your existing online infrastructure:

1. Integration

2. Custom code fields

3. FlexUI

4. DNS and HTTPS (certificate)

Integration

Ease of integration is a key to adopting any new IT system. Payment Pages provides integration with your existing website and business processes via HTTPS post and get operations. Customer and transaction data, like that stored in a shopping cart, can be passed to Payment Pages and displayed for customer reference and/or stored in our encrypted database. In addition, Tangible provides Consulting Services for the integration process to ensure a seamless connection is built between your website and the Tangible Payments system.

Custom Code Fields

Tangible Payments Payment Pages use of Custom Code Fields enables customization of the data entered and stored in our PCI DSS complaint payment system. The Custom Code Fields are ideally suited to storing internal business codes. Strings of up to one hundred characters in length (customer account codes, etc) can be stored in these fields. This allows for the persistence of transaction data that is important to your business processes, but is not provided for in our pre-formatted data fields. Up to ten custom fields can be included in payments processed by Payment Pages.

FlexUI

Tangible understands that an outsourced portal needs to provide the same look and feel as your corporate website. All UI components of Tangible Payments provide FlexUI, a unique ability to easily wrap your corporate look and feel within the Tangible Payments product. For example, Payment Pages can have the same header, side menu, footer, and style sheets as your corporate website.

DNS and HTTPS (Certificate)

In addition to FlexUI, Tangible Payments allows for specialized DNS so that customers using Payment Pages appear to be using a merchant’s system. For example, users hitting the site https://payments.yourbusiness.com will actually be hitting Tangible Payments through an HTTPS connection. Tangible engineers will work with the merchant to acquire the necessary certificates so that HTTPS connections with specialized DNS settings are enabled.

Payment Pages Process Flow

The following section provides more details about the process flow of Tangible Payments Payment Pages.

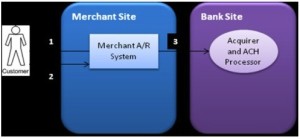

Existing Merchant Scenario

Most merchants process payments from their customers received via mail or in person at a point of sale. This process will always be required; however, customers have come to expect the convenience of online payment options.

Figure 4: Existing Merchant Scenario

- Merchant solicits payment via postal mail or at point of sale

- Customer responds with a check via postal mail, or a credit card payment through a point of sale device.

Merchant processes the received payment either through physical delivery to the bank or electronic transfer.

Tangible Payments Payment Pages Scenarios

Payment Pages provides those merchants who wish to take payments from online customers with the infrastructure to do so, while sparing them the costs associated with developing their own payment system.

There are four major options with Payment Pages:

- Link to Payment Pages from merchant website

- Payment Pages as standalone portal

- Payment Pages as a customer service tool

- Payment Pages as part of a complete A/R Solution

Scenario 1: Link to Payment Pages from merchant website

In this scenario, the merchant wants an online payment portal for their customers, which is directly integrated with their existing online infrastructure. This allows the merchant to use the existing infrastructure to interact with its customers and simply add the functionality of Payment Pages to that infrastructure.

The following diagram depicts online payment process when Payment Pages is integrated with a merchant website:

Figure 5: Link to Payment Pages from merchant website

- Customer accesses merchant website.

- Customer follows link from merchant website to Tangible Payments Payment Pages.

- Transaction data, customer account information or other internal business data maybe passed to Payment Pages via HTTPS Post and/or Get operations

- Customer enters payment information via the Enter Payment Page

- Customer confirms payment details on the Confirm Payment Page and submits the payment.

- Tangible Payments Gateway, our secure (PCI DSS compliant) payment processing system, processes the payment.

- A receipt is returned to the customer in the form of the Receipt Page.

Scenario 2: Payment Pages as a standalone portal

In this scenario, the merchant wants an online portal for customer payments, but don’t want it connected to their existing online infrastructure. This scenario is often seen when a merchant’s online infrastructure is limited or non-existent.

The following diagram depicts the online payment process through Payment Pages as a standalone portal:

Figure 6: Payment Pages as standalone portal

- Merchant sends customer instructions for accessing Payment Pages via email or as part of a printed invoice.

- The customer accesses Payment Pages directly, as instructed.

- Customer enters payment information via the Enter Payment Page

- Customer confirms payment details on the Confirm Payment Page and submits the payment.

- Tangible Payments Gateway, our secure (PCI DSS compliant) payment processing system, processes the payment.

- A receipt is returned to the customer in the form of the Receipt Page.

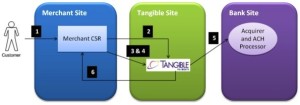

Scenario 3: Payment Pages as a customer service tool

In this scenario, the merchant wants a simple tool that allows a customer service representative (CSR) to take payments from customers over the phone. In this scenario Payment Pages acts as an easy to use add-on to Tangible Payments Payment Processing.

The following diagram depicts the payment process when Payment Pages is used by a CSR:

Figure 7: Payment Pages as a customer service tool

- The customer contacts the merchant to make a payment.

- The CSR accesses Payment Pages directly.12

Use or disclosure of data contained on this sheet is subject to restriction on the title page of this document.

- CSR enters the customer’s payment information via the Enter Payment Page

- CSR confirms payment details on the Confirm Payment Page and submits the payment.

- Tangible Payments Gateway, our secure (PCI DSS compliant) payment processing system, processes the payment.

- A receipt is returned to the CSR in the form of the Receipt Page.

Scenario 4: Payment Pages as part of a Complete A/R Solution

Payment Pages is not able to function as a complete A/R solution by itself, but when integrated with other elements of the Tangible Payments system Payment Pages serve as a valuable A/R tool.

All payments which pass through the Tangible Payments Gateway, including those made via Payment Pages, are recorded in our encrypted (PCI DSS compliant) database. The reconciliation features of our Payment Processing solution allow lockbox files to be automatically generated and passed to your business’s exiting A/R systems; ensuring that payments made through Payment Pages, or any other Tangible Payments system, are accurately accounted for. Additional details on this and other features of Tangible Payments Payment Processing can be found in the “Tangible Payments Payment Processing: How it works” document.

Merchants who wish a more comprehensive A/R solution are advised to consider Tangible Payments Bill Presentment. Described in the “Tangible Payments Invoice Management and Bill Presentment: How it works” document, this solution offers invoice management and delivery services. Bill Presentment also allows customers to create user accounts, view invoices and make payments against those invoices. Tangible Payments Bill Presentment is the ideal solution for merchants who need a way to increase their A/R turnover and decrease the labor required to process paid invoices.