Overview

As merchants increase their customer base, the manual accounts receivable (A/R) process can become expensive and cost prohibitive. Merchants need a way to increase the A/R turnover and decrease the labor required to process paid invoices.

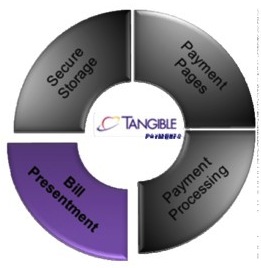

When considering Bill Presentment functionality, merchants should go the next step to a complete invoice management system. Tangible Payments offers a complete Invoice Management solution which covers bill generation, mailing, email, fax, online bill presentment, lock box file generation, customer payment solutions.

Tangible Payments Invoice Management (“Invoice Management”) is a hosted solution where your customers may view invoices, pay full or partial bills online, and view past payments – all within a portal that maintains the look and feel of your corporate website. The Invoice Management solution provides the complete lifecycle of invoice management, from invoice collection, to invoice presentation, to payment processing, to lockbox file generation back to the merchant’s financial system. In addition, with features, such as AutoPay, ShortPay, and FuturePay, Invoice Management is a solution that provides your customers with the flexibility to pay bills at their convenience and increases the speed in which funds arrive in your account.

Tangible Payments Invoice Management and Bill Presentment integrated directly with Tangible Payments Gateway.

Invoice Management Functionality

Available Actions to the Customer

The following actions are available to the customer via the Invoice Management System:

- Registration

- View invoices

- Make invoice payment

- Automated payments

- View past payments

- Setup notifications

Registration

The first time a customer accesses the Invoice Management portal, they will be required to register. Registration is the concept of creating a username and tying the username to an account. To ensure that only the owner of the invoice can access their invoices, the customer will be required to enter data about their account during the registration process. For example, a customer may be asked to enter their account number, street address, and customer name. The key fields required by a customer are customizable by merchant. Once a customer is successfully registered, they may perform all other actions within the system (defined below).

Figure 1: Example Registration Page

View Invoices

Customers can view a list of all current and past invoices. The invoices will detail the original amount due, and the amount left to be paid on the invoice.

In addition to the normal debit operations, Invoice Management provides the capabilities of credits as well. For example, a merchant could have overcharged a customer accidentally and decides to invoice the customer a credit. The customer can use the credit at any time, and in conjunction with any invoice.

If bill presentment is enabled for the customer, the bill is available to the customer via hyperlinks in the portal. The customer can view the bills at his/her convenience.

Figure 2: Example Invoice View Page

Make Invoice Payment

Invoice Management provides customers the ability to pay their invoices in a variety of ways:

- Normal: Customers can select one or more invoices and pay the invoices as one lump sum.

- ShortPay: Customers can pay part of the invoice amount. For example, the total invoice amount is $100. A customer decides they wish to pay the invoice in two installments of $50 each.

- FuturePay: Customers can specify when the payment should be processed. If no date is specified, the payment will be processed immediately (in real‐time). If a date is specified, the payment will be process as part of a batch process as indicated by the merchant (most merchants usually select 10PM or 2AM).

- Credit: Customers can include any credits in their selection of invoices. The use of credits will decrease the total dollar amount paid by the customer during the invoice payment process.

Figure 3: Example Payment Page

Automated Payments

Customers have two choices regarding automated payments (payments which are made on behalf of the customer): Pay on Schedule and AutoPay.

Pay on Schedule

Pay on Schedule Payments is the ability for a customer to define a fixed dollar amount that is billed on a specified frequency. This capability is very useful for customers that are billed the same dollar amount on a regular basis. Examples of these invoices are mortgages, car loans, and telecommunication bills.

Customers have a variety of options with regard to the account where funds will be pulled, and the frequency of payments (as show in the Figure below).

Figure 4: Example of Pay on Schedule

AutoPay

Customers may sign up for AutoPay, a feature which automatically bills a customer’s payment account when a new invoice is available. For example, a customer who receives electricity bills and who has signed up for AutoPay will automatically pay the invoice as soon as the invoice is available. Unlike recurring payments, AutoPay works with invoices that change in dollar amount.

AutoPay removes the need for the customer to worry about logging into the system and manually paying the bill. In addition, the benefit to the merchant is that bills are automatically paid by the customer as soon as the bill is invoiced. This can increase the payment turnover by a significant amount.

View Past Payments

Customers may view all past payments against invoices through Invoice Management. The past payments will include all invoices that were paid, transaction date, transaction type, amount, and payment status. All payments (whether successfully paid or not) will be kept for a minimum of 3 years.

Setup Notifications

Figure 6: Example Past Transactions

Customers can setup email notifications within Invoice Management for the following events:

- A new invoice is posted to the customer’s account

- A scheduled payment was posted to the customer’s account

Merchants can use the default message defined by Tangible, or use a custom message that is tailored to their business.

Integration

Figure 7: Example Notifications Page

Ease of integration is a key to adopting any new IT system. Invoice Management provides integration with several financial systems (e.g., PeopleSoft) as well as adapters for common file formats such as CVS and XML. In addition, Tangible provides Consulting Services in the event that merchants use legacy or custom build financial applications that may require integration outside the core set available through Tangible Payments.

FlexUI

Tangible understands that an outsourced portal needs to provide the same look and feel as your corporate website. All UI components of Tangible Payments provide FlexUI, a unique ability to easily wrap your corporate look and feel within the Tangible Payments product. For example, the Invoice Management portal can have the same header, side menu, footer, and style sheets as your corporate website.

DNS and HTTPS (Certificate)

In addition to FlexUI, Tangible Payments allows for specialized DNS so that customers using Tangible Payments appear to be using a merchant’s system. For example, users hitting the site https://payments.merchant.com will actually be hitting Tangible Payments through an HTTPS connection. Tangible engineers will work with the merchant to acquire the necessary certificates so that HTTPS connections with specialized DNS settings are enabled.

Invoice Management Process Flow

The following section provides more details about the process flow of Tangible Payments Invoice Management solution.

Existing Merchant Scenario

Most merchants manually send invoices to their customers, wait for a payment via postal mail, and process the paper payments physically or through automation (e.g., ARC conversion). This manual process will always be required, however, as the number of invoices grow, this business process is not efficient.

Figure 8: Existing Merchant Scenario

- Merchant send invoice via postal mail or email

- Customer responds via postal mail with check, or credit card written on paper.

- Merchant processes the received payment either through physical delivery or electronic conversion (e.g., ARC or manual credit card entry).

Tangible Payments Invoice Management Scenarios

Tangible Payments Invoice Management and Bill Presentment (“Invoice Management”) solves the customer invoicing issues by providing an end‐to‐end solution for outsourcing a customer facing portal in which customers can view and pay invoices online.

There are two major options available regarding Invoice Management:

- Invoice Management (Merchant Invoices Customer Directly)

- Invoice Management (Tangible Invoices Customer Directly)

Scenario 1: Merchant Invoices Customer Directly

In this scenario, the merchant wants a customer portal for invoice management, but still wishes to use the existing infrastructure to bill the customers directly (i.e., use the existing merchant printing/emailing solution).

The following diagram depicts Invoice Management when a merchant invoices customers directly:

Figure 9: Invoice Management (Merchant Invoices Customer Directly)

- Merchant sends account data, invoice data, and optionally the PDF (or image) of the invoice via FTP to Tangible Payments Invoice Management on a daily basis. The information is batched within the Invoice Management System and made available to the customer for the next day.

- In certain cases, merchants make mistakes in the billing process. To this end, Invoice Management allows merchants to update past invoices as long as the customer has not made payments against the invoice.

- Merchant sends the invoice (e.g., postal, email) to the customer. Included in the invoice is a section regarding how to pay the bill online (potentially with a hyperlink if an email).

- Customer accesses the Invoice Management site and creates a username/password using information on the invoice (or logs in if the customer has already created a username). Once logged into the system, the customer can access all functionality that is available to a merchant’s customers.

- If a payment is made via the Invoice Management System, the payment goes through the Tangible Payments Gateway (which includes all the benefits of using the Tangible Gateway).

- Merchant system will pull a lockbox file on a daily basis which details the payments made against the invoices.

Scenario 2: Tangible Invoices Customer Directly

In this scenario, the merchant wants a customer portal for invoice management, and wants Tangible to handle the invoicing of the customer.

The following diagram depicts Invoice Management when Tangible invoices the customer directly:

Figure 10: Invoice Management (Tangible Invoices Customer Directly)

- Merchant sends account data, invoice data, and optionally the PDF (or image) of the invoice via FTP to Tangible Payments Invoice Management on a daily basis. The information is batched within the Invoice Management System and made available to the customer for the next day.In certain cases, merchants make mistakes in the billing process. To this end, Invoice Management allows merchants to update past invoices as long as the customer has not made payments against the invoice.

- Tangible will automatically generate the invoice and send the invoice to the end customer either via postal, email, or fax. Included in the invoice is a section regarding how to pay the bill online (potentially with a hyperlink if an email).

- Customer accesses the Invoice Management site and creates a username/password using information on the invoice (or logs in if the customer has already created a username). Once logged into the system, the customer can access all functionality that is available to a merchant’s customers.

- If a payment is made via the Invoice Management System, the payment goes through the Tangible Payments Gateway (which includes all the benefits of using the Tangible Gateway).

- Merchant system will pull a lockbox file on a daily basis which details the payments made against the invoices.