Overview

Every merchant needs to be able to handle customer payments in a secure and efficient manner. This is especially true of merchants with extensive customer bases and/or merchants moving large sums of money. Processing payments and maintaining accurate payment records can easily become a costly undertaking for such merchants.

Tangible Payments Payment Processing (“Payment Processing”) is a hosted solution that allows your business to process credit card and automated clearing house (electronic check) payments, set-up customer accounts with recurring payment schedules, maintain detailed payment records and generate reports from those records – all through a PCI DSS compliant web-portal.

The front end of Payment Processing is the Payment Management Portal (“PMP”), an easy to use graphic user interface accessible online via secure HTTP (HTTPS) connections. The back end of Payment Processing is an encrypted database maintained at a high security data center. The core of Payment Processing is the Tangible Payment’s Gateway, a sophisticated application which connects to banks and credit card acquirers to process payments, records all transactions in the encrypted DB, creates detailed reports of payment activity, maintains a thorough audit trail for extra security and generates lockbox files for integration with your business’s existing financial systems.

The online PMP allows Tangible Payments Payment Processing to function as an ideal call center application. It allows any customer service representative (CSR) with internet access to process one time payments or to set-up customer accounts for repeat business. The reporting capabilities of Payment Processing allows for comprehensive and detailed searching of payment records, which can provide insights into customer activity that are of value to accounting and management personnel.

Payment Processing Functionality

The following section provides more details about the Tangible Payments Payment Processing solution.

Features of Payment Management Portal

The following functions are available to the user via the Payment Management Portal:

- User administration

- Credit card processing

- ACH processing

- Customer account management

- Generating reports

User Administration

Tangible Payments Payment Processing grants control of user account creation and administration to our clients. After the initial setup of your merchant on our system an administrator account will be created for one of your users. This account is then used by your personnel to establish and control additional user access. This security feature ensures that access to your sensitive business data is under your control.

Credit Card Processing

Tangible Payments Payment Processing handles of all types of credit card transactions. Credit card payments can be authorized and captured in a single action, or a two step process can be used; consisting of a pre-authorization followed by a capture of the funds at a later time. Refunds can by issued against specific transactions, or credits can be issued towards a customer’s account.

ACH Processing

Automated Clearing House transactions (electronic check) transactions are can also be handled by Tangible Payments Payment Processing. Funds can be transferred directly from a customer’s checking account to make a payment. Funds may also be transferred into a customer’s account as refunds against specific transactions or general credits. Payment Processing also allows you to void ACH transactions which have not yet been settled to the bank. (Settlements are usually conducted on a daily basis.)

Customer Account Management

Tangible Payments Payment Processing supports the creation and maintenance of customer profiles on our PCI DSS compliant system, for the purpose of retaining sensitive payment information in a secure environment. This provides security for your customers’ information and protects your business from liability related to retaining credit card or bank account data.

Customer accounts can be created and maintained via the PMP and API calls. Payments made using these accounts are recorded, enabling you to track your customers’ payment histories. These accounts can also be used to set up schedules of recurring payments; providing an extra level of automation for your business and convenience for your customers.

Tangible Payments Payment Processing is fully integrated with our Secure Storage and Bill Presentment solutions. Customer accounts can be created and maintained using these solutions. Please see the “Tangible Payments Secure Storage: How it Works” and “Tangible Payments Invoice Management and Bill Presentment: How it Works” documents for further details. Customer accounts created using these elements of the Tangible Payments system are accessible through the Payment Processing PMP.

Generating Reports

Tangible Payments Payment Processing maintains detailed records of every payment made through the Tangible Payments Gateway. These records, stored in our PCI DSS compliant database, can be used to generate reports via the PMP. Database searches can be launched using more than a dozen different search criteria and the results exported as a spreadsheet in CSV format. For example; your personnel will be able to easily generate reports showing all payment activity in the past month, you could pull up the complete payment history of one of your customers, you can run a search to determine how many payments were made in excess of one thousand dollars, etc.

If existing reporting functions are not suited to your business needs customized reports can also be developed for your business and accessed through the PMP. Our development staff will work with your personnel to ensure that payment data needed for your business operations can be accessed quickly and easily.

Payment Processing Process Flow

The following section provides more details about the process flow of the Tangible Payments Payment Processing solution.

Existing Merchant Scenario

A merchant without a payment processing gateway will accept payment from their customers in the form cash, check or credit card presented at the point of sale. Sensitive payment information is either not stored, or (if stored) the merchant assumes liability for that information.

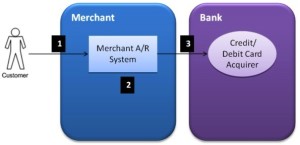

Figure 1: Existing Merchant Scenario

- Customer provides merchant with payment

- Merchant records receipt of payment in their A/R system.

- Merchant deposits the received payment either through physical delivery or electronic transfer (e.g., credit card settlement).

Tangible Payments Payment Processing Scenarios

Tangible Payments Payment Processing (“Payment Processing”) provides the merchant with the ability to accept credit card (card not present) and ACH payments and to automate recurring payments.

There are two major options available regarding Payment Processing:

- One time payment

- Recurring payments

Scenario 1: One Time Payment

In this scenario, the customer is making a single payment to the merchant.

The following diagram depicts Payment Processing when a customer is making a single payment:

Figure 2: One Time Payment

- Customer provides payment information to the merchant’s customer service representative (CSR).

- Merchant CSR accesses the Tangible Payments PMP website and enters the customer’s information.

- Customer information may or may not be saved in a customer account in the Tangible Payments secure (PCI DSS compliant) database.

- Tangible Payments Payment Processing processes the payment through the merchant bank or credit card acquirer.

- Payment details are stored in Tangible Payments secure (PCI DSS compliant) database.

- Payment records stored by Tangible Payments Payment Processing are reconciled with merchant A/R systems

Scenario 2: Recurring Payments

In this scenario, the customer authorizes the merchant to take regular payments from their credit card or bank account.

The following diagram depicts Payment Processing when recurring payments are made.

Figure 3: Recurring Payments

- Customer provides payment information to merchant CSR.

- Merchant CSR creates a customer account in Tangible Payments, and configures it for recurring payments (creates a payment schedule).

- Tangible Payments stores the customer account data in our secure (PCI DSS compliant) database.

- Tangible Payments Payment Processing processes the payment through the merchant bank or credit card acquirer according to the schedule setup by the CSR.

- Payment details are stored in Tangible Payments secure (PCI DSS compliant) database.

- Payment records stored by Tangible Payments Payment Processing are reconciled with merchant A/R systems